*/

Peter Susman QC updates his December 2017 article by trying to answer two further questions he has been asked by a number of readers

Suppose that you and a number of other people deposit money in your bank. The bank lends deposited monies to other customers of the bank. So where is your money now? My answer, for present purposes, is that your money is on the bank’s ledger. At one time the ledger was kept up to date by hand, but now on a computer operated by your bank. In effect, and provided you subscribe to internet banking, you can communicate directly with the bank’s ledger in order to transfer money from your bank account to someone else’s, without the intervention of any human being who works for the bank.

Again, suppose you want to use your computer to send someone an email message. You need a provider of email services, plus the email address of the person addressed, but you do not need a centralised post office.

The blockchain goes one large step further. It is in effect a computerised ledger that may be used (among other possible applications) for recording transactions in what purports to be a currency (a cryptocurrency) such as Bitcoin. The innovation is that a copy of the ledger recording transactions is kept on the computer of everyone who subscribes to the system. The data is kept within a series of finite blocks of such data, each connected in a chain of blocks, which is why it is called a blockchain.

Because the blockchain is a distributed ledger, it is not the equivalent of a bank’s centralised ledger, even when used to effect a transfer of cryptocurrency such as Bitcoin. It is not the equivalent of the email system, even when used to transmit information, and even if access to data kept on the distributed ledger is gained by the use of a coded ‘public key’ (which in function might be compared to an email service provider) plus a coded ‘private key’ (which in function might be compared to an email address).

In short, a blockchain may be said to function typically as a distributed ledger of data which records transactions in cryptocurrency effected without the intervention of a bank or a post office.

At the beginning of 2017, the price at which one Bitcoin was traded on Bitcoin exchanges was about US$1,000. By the middle of December 2017, the month in which my previous article was published, the price was at or near 20 times as much, namely just under US$20,000. At the time of writing this subsequent contribution, the price has fallen back to about US$6,000. Remember that there is very little that you can use Bitcoin to buy, unless you are a criminal purchasing on the so-called Dark Web!

Some commentators have accordingly suggested that neither Bitcoin nor any other cryptocurrency should properly be regarded as a ‘medium of exchange’, in other words as the equivalent of an established currency, but should be regarded more as a commodity such as gold. I disagree. Gold has an intrinsic value because it is a rare metal capable of being used for another purpose, and in particular for fashioning jewellery. Others suggest that the enormous quantity of electricity needed to produce new Bitcoin by ‘mining’ gives Bitcoin an intrinsic value. Again I disagree, viewing cost of production as irrelevant to intrinsic value. I suggest that a better comparison is that Bitcoin should be regarded as the equivalent of paper bank notes issued as currency in a country where scarcely anyone will accept them in payment for anything, so that they have no intrinsic value: they are used mostly for buying and selling, like the tin of sardines in the old joke, where a thriving market was ruined by the man who opened the tin and ate the sardines. So I would tend to discount the views of those who regard cryptocurrencies as the medium of exchange of the future, in preference to the views of those who regard their inevitable eventual final value as very close to zero.

I therefore suggest that the market in Bitcoin should indeed be regarded as no more than a bubble. Why then should anyone invest in it? I cite the wise words of Lewison LJ in a different context in Mundy v The Trustees of the Sloane Stanley Estate [2018] EWCA Civ 35 at para [42]:

‘Sometimes markets behave irrationally. The Tulip mania of the mid-seventeenth century, the South Sea Bubble of the early eighteenth century, the railway mania of the mid-nineteenth century and the dot-com bubble of the late twentieth century are well-known examples. Even in the absence of these extreme examples, markets are often influenced by what John Maynard Keynes called “animal spirits”.’

Contributor Peter Susman QC, Henderson Chambers. Peter’s previous article, ‘Blockchain, Bitcoin and the Bar’, appeared in the December 2017 issue of Counsel.

Suppose that you and a number of other people deposit money in your bank. The bank lends deposited monies to other customers of the bank. So where is your money now? My answer, for present purposes, is that your money is on the bank’s ledger. At one time the ledger was kept up to date by hand, but now on a computer operated by your bank. In effect, and provided you subscribe to internet banking, you can communicate directly with the bank’s ledger in order to transfer money from your bank account to someone else’s, without the intervention of any human being who works for the bank.

Again, suppose you want to use your computer to send someone an email message. You need a provider of email services, plus the email address of the person addressed, but you do not need a centralised post office.

The blockchain goes one large step further. It is in effect a computerised ledger that may be used (among other possible applications) for recording transactions in what purports to be a currency (a cryptocurrency) such as Bitcoin. The innovation is that a copy of the ledger recording transactions is kept on the computer of everyone who subscribes to the system. The data is kept within a series of finite blocks of such data, each connected in a chain of blocks, which is why it is called a blockchain.

Because the blockchain is a distributed ledger, it is not the equivalent of a bank’s centralised ledger, even when used to effect a transfer of cryptocurrency such as Bitcoin. It is not the equivalent of the email system, even when used to transmit information, and even if access to data kept on the distributed ledger is gained by the use of a coded ‘public key’ (which in function might be compared to an email service provider) plus a coded ‘private key’ (which in function might be compared to an email address).

In short, a blockchain may be said to function typically as a distributed ledger of data which records transactions in cryptocurrency effected without the intervention of a bank or a post office.

At the beginning of 2017, the price at which one Bitcoin was traded on Bitcoin exchanges was about US$1,000. By the middle of December 2017, the month in which my previous article was published, the price was at or near 20 times as much, namely just under US$20,000. At the time of writing this subsequent contribution, the price has fallen back to about US$6,000. Remember that there is very little that you can use Bitcoin to buy, unless you are a criminal purchasing on the so-called Dark Web!

Some commentators have accordingly suggested that neither Bitcoin nor any other cryptocurrency should properly be regarded as a ‘medium of exchange’, in other words as the equivalent of an established currency, but should be regarded more as a commodity such as gold. I disagree. Gold has an intrinsic value because it is a rare metal capable of being used for another purpose, and in particular for fashioning jewellery. Others suggest that the enormous quantity of electricity needed to produce new Bitcoin by ‘mining’ gives Bitcoin an intrinsic value. Again I disagree, viewing cost of production as irrelevant to intrinsic value. I suggest that a better comparison is that Bitcoin should be regarded as the equivalent of paper bank notes issued as currency in a country where scarcely anyone will accept them in payment for anything, so that they have no intrinsic value: they are used mostly for buying and selling, like the tin of sardines in the old joke, where a thriving market was ruined by the man who opened the tin and ate the sardines. So I would tend to discount the views of those who regard cryptocurrencies as the medium of exchange of the future, in preference to the views of those who regard their inevitable eventual final value as very close to zero.

I therefore suggest that the market in Bitcoin should indeed be regarded as no more than a bubble. Why then should anyone invest in it? I cite the wise words of Lewison LJ in a different context in Mundy v The Trustees of the Sloane Stanley Estate [2018] EWCA Civ 35 at para [42]:

‘Sometimes markets behave irrationally. The Tulip mania of the mid-seventeenth century, the South Sea Bubble of the early eighteenth century, the railway mania of the mid-nineteenth century and the dot-com bubble of the late twentieth century are well-known examples. Even in the absence of these extreme examples, markets are often influenced by what John Maynard Keynes called “animal spirits”.’

Contributor Peter Susman QC, Henderson Chambers. Peter’s previous article, ‘Blockchain, Bitcoin and the Bar’, appeared in the December 2017 issue of Counsel.

Peter Susman QC updates his December 2017 article by trying to answer two further questions he has been asked by a number of readers

The Chair of the Bar sets out how the new government can restore the justice system

In the first of a new series, Louise Crush of Westgate Wealth considers the fundamental need for financial protection

Unlocking your aged debt to fund your tax in one easy step. By Philip N Bristow

Possibly, but many barristers are glad he did…

Mental health charity Mind BWW has received a £500 donation from drug, alcohol and DNA testing laboratory, AlphaBiolabs as part of its Giving Back campaign

The Institute of Neurotechnology & Law is thrilled to announce its inaugural essay competition

How to navigate open source evidence in an era of deepfakes. By Professor Yvonne McDermott Rees and Professor Alexa Koenig

Brie Stevens-Hoare KC and Lyndsey de Mestre KC take a look at the difficulties women encounter during the menopause, and offer some practical tips for individuals and chambers to make things easier

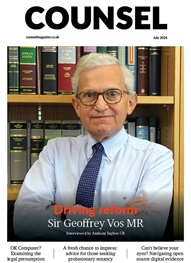

Sir Geoffrey Vos, Master of the Rolls and Head of Civil Justice since January 2021, is well known for his passion for access to justice and all things digital. Perhaps less widely known is the driven personality and wanderlust that lies behind this, as Anthony Inglese CB discovers

The Chair of the Bar sets out how the new government can restore the justice system

No-one should have to live in sub-standard accommodation, says Antony Hodari Solicitors. We are tackling the problem of bad housing with a two-pronged approach and act on behalf of tenants in both the civil and criminal courts