*/

Information recently released by the National Crime Agency (NCA) demonstrates why the legal framework for reporting a money laundering suspicion set out in s 330 of the Proceeds of Crime Act 2002 should be subject to review and legislative reform.

This section imposes an obligation on individuals and businesses to disclose to the NCA information which gives reasonable grounds for suspecting that another person is engaged in money laundering. Failure to make a disclosure is punishable by a maximum sentence of five years’ imprisonment and an unlimited fine.

According to the UK Financial Intelligence Unit’s Annual Report 2022 on Suspicious Activity Reports (SARs) published in January this year, the NCA received a gargantuan number of SARs last year. 901,255, to be precise.

This reflects a 21% increase on the previous year and is consistent with the exponential growth in the number of SARs submitted since the NCA was established in 2013. Then, the number received was 316,527.

Over 80% of SARs are lodged in the UK by financial services providers such as banks, building societies and money service businesses. In most cases, the initial cause for suspicion is triggered by anti-money laundering software systems designed to identify red flags.

Last year, less than 1% of SARs were filed by solicitors and accountants. In 2020/21, barristers filed nine SARs. This reduced to four last year.

The low level of reports from lawyers, and to some extent accountants, is explained by the provision in s 330(6) which provides that a ‘failure to report’ offence is not committed when suspicious information is communicated in circumstances where legal privilege is engaged. The ability to assert legal privilege is extended to ‘a relevant professional adviser’ such as an accountant or chartered tax adviser in certain circumstances.

Leaving aside lawyers and accountants, the figures suggest there is significant over-reporting taking place.

With the submission of such a high number of SARs, the UK is an international outrider. In Germany, around 300,000 SARs were submitted to the authorities in 2021. Statisticians have calculated that in 2017 the NCA received 47 SARs per €1 billion of assets, a rate six times higher than that of France and Germany.

However, these reports do not always contain good quality criminal intelligence. In June 2019, the Law Commission (No 384) expressed concern that there were many SARs which contained poor quality information. Low quality SARs can take considerable time to process and distract the NCA from its important work.

A major cause of the large volume of SARs filed with the NCA is the width of the reporting requirement.

There is considerable uncertainty surrounding the meaning of suspicion when determining whether a SAR should be made. The interpretation of suspicion applied by the courts directs reporters to ask whether there is a possibility which is more than fanciful that the relevant facts exist (R v Da Silva [2006] EWCA Crim 1654). It is difficult to know what ‘fanciful’ means in this context. Dictionary definitions suggest that ‘fanciful’ connotes something which is imaginative or unrealistic.

This is a remarkedly low threshold and invites speculation on the part of the reporter.

The Law Commission heard evidence that the threat of individual criminal liability for failing to make a SAR encourages defensive reporting. Money laundering reporting officers tend to err on the side of caution where prosecution may result from making the wrong judgment call.

Although the NCA has issued additional guidance since the Law Commission’s report was published, the reporting criteria in s 330 remain unamended and the number of SARs filed has continued to increase.

Whether in the light of these concerns the SARs regime remains efficacious is unclear. This, however, is a key question. The filing of a SAR involves a major invasion of privacy which can be justified only if the regime is proportionate and effective as a tool in the fight against financial crime.

The NCA promotes in its annual report the notion that SARs provide an invaluable resource in tackling organised crime threats, particularly fraud, and ensures that criminals are denied the benefit of assets derived from their illegal activities.

But if the value of criminal property is taken as a measure of success, the figures are not especially impressive.

In 2020/21, after receiving SARs the NCA refused to permit dealings with suspected criminal property to the value of £112.8 million. This figure increased to £292.5 million in 2021/22. £141.1 million of this increase was attributable to seven cases in 2021/22 which fell into the £10 million to £50 million category. There were no cases in this range in 2020/21.

At first blush these figures may look impressive, but on reflection this is not so. It is unexceptional today for millions of pounds to be involved in a single case. For instance, in July 2021 a confiscation order was made against a defendant for £37.6 million following conviction for involvement in VAT fraud.

Similarly, in terms of arrests made following receipt of suspicious information in SARs, in previous years the number has been embarrassing small.

In 2018, following submission of 463,938 SARs, the NCA reported that 40 arrests in 28 cases had been made. In 2015, there had been 17 arrests in 16 cases after 381,882 SARs had been lodged.

The annual report is conspicuously silent on whether there have been more, or less, arrests triggered by SARs in 2022.

Moreover, this is not the only respect in which there is an information deficit regarding the operation of the SARs regime.

Of the 901,255 SARs submitted last year, it is important to know how many reports relate to the same individual and company which has been the subject of a previous report. In assessing the efficacy of the regime, it would be helpful to know how many SARs involved individuals and companies whose activities had been reported publicly in some form or other on the internet or were the subject of a current investigation.

Additionally, it is a shame that the annual report fails to indicate the value of criminal property attributable to tax evasion, and the number of civil investigations initiated by HM Revenue and Customs because of a SAR.

It is a matter of conjecture, but it is quite possible for the real value of the SARs regime to lie in combatting attacks on the public revenue by the business sector as well as organised crime.

In 2009, the European Union Committee of the House of Lords called for a comprehensive cost/benefit analysis to be undertaken, in order to determine whether the SARs regime is worth the effort and the cost.

As the number of SARs filed with the NCA continues to increase, it is more important than ever for the impact of the SARs regime to be fully understood. Unfortunately, the 2022 annual report leaves several important questions unanswered.

Building on the work of the Law Commission, the establishment by the Home Office of an independent and transparent cost/benefit analysis would be the first step in the right direction.

Over 80% of SARs are lodged in the UK by financial services providers such as banks, building societies and money service businesses. The National Crime Agency received 901,255 SARs in 2022. Less than 1% were filed by solicitors and accountants. In 2020/21, barristers filed nine SARs. This reduced to four last year.

Information recently released by the National Crime Agency (NCA) demonstrates why the legal framework for reporting a money laundering suspicion set out in s 330 of the Proceeds of Crime Act 2002 should be subject to review and legislative reform.

This section imposes an obligation on individuals and businesses to disclose to the NCA information which gives reasonable grounds for suspecting that another person is engaged in money laundering. Failure to make a disclosure is punishable by a maximum sentence of five years’ imprisonment and an unlimited fine.

According to the UK Financial Intelligence Unit’s Annual Report 2022 on Suspicious Activity Reports (SARs) published in January this year, the NCA received a gargantuan number of SARs last year. 901,255, to be precise.

This reflects a 21% increase on the previous year and is consistent with the exponential growth in the number of SARs submitted since the NCA was established in 2013. Then, the number received was 316,527.

Over 80% of SARs are lodged in the UK by financial services providers such as banks, building societies and money service businesses. In most cases, the initial cause for suspicion is triggered by anti-money laundering software systems designed to identify red flags.

Last year, less than 1% of SARs were filed by solicitors and accountants. In 2020/21, barristers filed nine SARs. This reduced to four last year.

The low level of reports from lawyers, and to some extent accountants, is explained by the provision in s 330(6) which provides that a ‘failure to report’ offence is not committed when suspicious information is communicated in circumstances where legal privilege is engaged. The ability to assert legal privilege is extended to ‘a relevant professional adviser’ such as an accountant or chartered tax adviser in certain circumstances.

Leaving aside lawyers and accountants, the figures suggest there is significant over-reporting taking place.

With the submission of such a high number of SARs, the UK is an international outrider. In Germany, around 300,000 SARs were submitted to the authorities in 2021. Statisticians have calculated that in 2017 the NCA received 47 SARs per €1 billion of assets, a rate six times higher than that of France and Germany.

However, these reports do not always contain good quality criminal intelligence. In June 2019, the Law Commission (No 384) expressed concern that there were many SARs which contained poor quality information. Low quality SARs can take considerable time to process and distract the NCA from its important work.

A major cause of the large volume of SARs filed with the NCA is the width of the reporting requirement.

There is considerable uncertainty surrounding the meaning of suspicion when determining whether a SAR should be made. The interpretation of suspicion applied by the courts directs reporters to ask whether there is a possibility which is more than fanciful that the relevant facts exist (R v Da Silva [2006] EWCA Crim 1654). It is difficult to know what ‘fanciful’ means in this context. Dictionary definitions suggest that ‘fanciful’ connotes something which is imaginative or unrealistic.

This is a remarkedly low threshold and invites speculation on the part of the reporter.

The Law Commission heard evidence that the threat of individual criminal liability for failing to make a SAR encourages defensive reporting. Money laundering reporting officers tend to err on the side of caution where prosecution may result from making the wrong judgment call.

Although the NCA has issued additional guidance since the Law Commission’s report was published, the reporting criteria in s 330 remain unamended and the number of SARs filed has continued to increase.

Whether in the light of these concerns the SARs regime remains efficacious is unclear. This, however, is a key question. The filing of a SAR involves a major invasion of privacy which can be justified only if the regime is proportionate and effective as a tool in the fight against financial crime.

The NCA promotes in its annual report the notion that SARs provide an invaluable resource in tackling organised crime threats, particularly fraud, and ensures that criminals are denied the benefit of assets derived from their illegal activities.

But if the value of criminal property is taken as a measure of success, the figures are not especially impressive.

In 2020/21, after receiving SARs the NCA refused to permit dealings with suspected criminal property to the value of £112.8 million. This figure increased to £292.5 million in 2021/22. £141.1 million of this increase was attributable to seven cases in 2021/22 which fell into the £10 million to £50 million category. There were no cases in this range in 2020/21.

At first blush these figures may look impressive, but on reflection this is not so. It is unexceptional today for millions of pounds to be involved in a single case. For instance, in July 2021 a confiscation order was made against a defendant for £37.6 million following conviction for involvement in VAT fraud.

Similarly, in terms of arrests made following receipt of suspicious information in SARs, in previous years the number has been embarrassing small.

In 2018, following submission of 463,938 SARs, the NCA reported that 40 arrests in 28 cases had been made. In 2015, there had been 17 arrests in 16 cases after 381,882 SARs had been lodged.

The annual report is conspicuously silent on whether there have been more, or less, arrests triggered by SARs in 2022.

Moreover, this is not the only respect in which there is an information deficit regarding the operation of the SARs regime.

Of the 901,255 SARs submitted last year, it is important to know how many reports relate to the same individual and company which has been the subject of a previous report. In assessing the efficacy of the regime, it would be helpful to know how many SARs involved individuals and companies whose activities had been reported publicly in some form or other on the internet or were the subject of a current investigation.

Additionally, it is a shame that the annual report fails to indicate the value of criminal property attributable to tax evasion, and the number of civil investigations initiated by HM Revenue and Customs because of a SAR.

It is a matter of conjecture, but it is quite possible for the real value of the SARs regime to lie in combatting attacks on the public revenue by the business sector as well as organised crime.

In 2009, the European Union Committee of the House of Lords called for a comprehensive cost/benefit analysis to be undertaken, in order to determine whether the SARs regime is worth the effort and the cost.

As the number of SARs filed with the NCA continues to increase, it is more important than ever for the impact of the SARs regime to be fully understood. Unfortunately, the 2022 annual report leaves several important questions unanswered.

Building on the work of the Law Commission, the establishment by the Home Office of an independent and transparent cost/benefit analysis would be the first step in the right direction.

Over 80% of SARs are lodged in the UK by financial services providers such as banks, building societies and money service businesses. The National Crime Agency received 901,255 SARs in 2022. Less than 1% were filed by solicitors and accountants. In 2020/21, barristers filed nine SARs. This reduced to four last year.

The Chair of the Bar sets out how the new government can restore the justice system

In the first of a new series, Louise Crush of Westgate Wealth considers the fundamental need for financial protection

Unlocking your aged debt to fund your tax in one easy step. By Philip N Bristow

Possibly, but many barristers are glad he did…

Mental health charity Mind BWW has received a £500 donation from drug, alcohol and DNA testing laboratory, AlphaBiolabs as part of its Giving Back campaign

The Institute of Neurotechnology & Law is thrilled to announce its inaugural essay competition

How to navigate open source evidence in an era of deepfakes. By Professor Yvonne McDermott Rees and Professor Alexa Koenig

Brie Stevens-Hoare KC and Lyndsey de Mestre KC take a look at the difficulties women encounter during the menopause, and offer some practical tips for individuals and chambers to make things easier

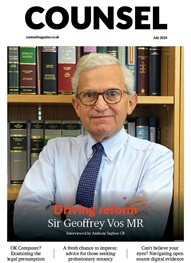

Sir Geoffrey Vos, Master of the Rolls and Head of Civil Justice since January 2021, is well known for his passion for access to justice and all things digital. Perhaps less widely known is the driven personality and wanderlust that lies behind this, as Anthony Inglese CB discovers

The Chair of the Bar sets out how the new government can restore the justice system

No-one should have to live in sub-standard accommodation, says Antony Hodari Solicitors. We are tackling the problem of bad housing with a two-pronged approach and act on behalf of tenants in both the civil and criminal courts