*/

You have the best of intentions. You are not going to leave your tax return to the last minute again this year. Slowly, the months tick by. ‘I’ll look at it tomorrow,’ you tell yourself. All of a sudden you find yourself amid the Christmas planning rush. Then you get busy in January and do not get a chance to get the information together. Now the deadline for submitting your return has passed and your tax return is late. Sound familiar?

First, do not panic. Second, do not bury your head in the sand. It is better to get up to date as soon as you can, rather than keep putting it off.

If you have an accountant, contact them, put up your hand and confess to your procrastination. Tell them that you want to put your tax affairs in order and ask them what information they will need from you to get your return to HMRC in the most expedient manner.

If you do not have an accountant, and do not want to appoint one, you will need to roll up your sleeves and wade through those chambers statements, your bank statements and credit card statements to put together your Income and Expenditure Statement and all the other pieces of information to put on your tax return.

Do not forget to include any gift aid payments or pension contributions as they will attract tax relief. Also, do not overlook any other sources of income such as dividends, bank interest, rental of income of your holiday flat in Margate and any overseas income. HMRC will know about these and you do not want them to be the ones to remind you that you have not included them on your tax return.

If you do not have an accountant, but want one, ask your colleagues whether they have anyone they would recommend. Everyone has a different experience, even with the same firm. Ring around and speak to a couple of firms. Find the practice that best suits you – not all accoutants are the same. The cheapest may not always be the best fit for you. Make sure that whoever you appoint has experience of dealing with barristers; you are a special breed for tax purposes.

Well, this depends on how late you are with your tax return:

This also will depend on when you finally pay the outstanding liability:

So, I can hear your renewed promise... I will not leave this to the last minute again. To help firm your resolve, here’s a reminder of the advantages to completing your return early:

With Making Tax Digital bringing in fundamental changes to the way the tax system works, you should now be keeping your records in some sort of software. Most accounting software packages these days provide the ability for you to share your data with your accountant. So as long as your VAT returns are up to date, your accountant will be in a better position to prepare your accounts earlier.

If you are struggling with keeping your records up to date, you could consider appointing a bookkeeper. Some accountancy firms can provide this service in addition to preparing your tax return and accounts. They will also be able to electronically submit your VAT returns for you.

When you receive information that your accountant will need for your tax return, such as dividend vouchers, annual interest statements and stockbroker reports, send them on to your accountant. They can keep a record of these statements for when they prepare your return, and you won’t be trawling through your mountain of paperwork for something you received eight or nine months earlier.

So, if your tax return is late, it will not be a complete disaster. But better to deal with it sooner rather than later. There are financial penalties, but the quicker you deal with the return, the lower these penalties will be.

You have the best of intentions. You are not going to leave your tax return to the last minute again this year. Slowly, the months tick by. ‘I’ll look at it tomorrow,’ you tell yourself. All of a sudden you find yourself amid the Christmas planning rush. Then you get busy in January and do not get a chance to get the information together. Now the deadline for submitting your return has passed and your tax return is late. Sound familiar?

First, do not panic. Second, do not bury your head in the sand. It is better to get up to date as soon as you can, rather than keep putting it off.

If you have an accountant, contact them, put up your hand and confess to your procrastination. Tell them that you want to put your tax affairs in order and ask them what information they will need from you to get your return to HMRC in the most expedient manner.

If you do not have an accountant, and do not want to appoint one, you will need to roll up your sleeves and wade through those chambers statements, your bank statements and credit card statements to put together your Income and Expenditure Statement and all the other pieces of information to put on your tax return.

Do not forget to include any gift aid payments or pension contributions as they will attract tax relief. Also, do not overlook any other sources of income such as dividends, bank interest, rental of income of your holiday flat in Margate and any overseas income. HMRC will know about these and you do not want them to be the ones to remind you that you have not included them on your tax return.

If you do not have an accountant, but want one, ask your colleagues whether they have anyone they would recommend. Everyone has a different experience, even with the same firm. Ring around and speak to a couple of firms. Find the practice that best suits you – not all accoutants are the same. The cheapest may not always be the best fit for you. Make sure that whoever you appoint has experience of dealing with barristers; you are a special breed for tax purposes.

Well, this depends on how late you are with your tax return:

This also will depend on when you finally pay the outstanding liability:

So, I can hear your renewed promise... I will not leave this to the last minute again. To help firm your resolve, here’s a reminder of the advantages to completing your return early:

With Making Tax Digital bringing in fundamental changes to the way the tax system works, you should now be keeping your records in some sort of software. Most accounting software packages these days provide the ability for you to share your data with your accountant. So as long as your VAT returns are up to date, your accountant will be in a better position to prepare your accounts earlier.

If you are struggling with keeping your records up to date, you could consider appointing a bookkeeper. Some accountancy firms can provide this service in addition to preparing your tax return and accounts. They will also be able to electronically submit your VAT returns for you.

When you receive information that your accountant will need for your tax return, such as dividend vouchers, annual interest statements and stockbroker reports, send them on to your accountant. They can keep a record of these statements for when they prepare your return, and you won’t be trawling through your mountain of paperwork for something you received eight or nine months earlier.

So, if your tax return is late, it will not be a complete disaster. But better to deal with it sooner rather than later. There are financial penalties, but the quicker you deal with the return, the lower these penalties will be.

The Chair of the Bar sets out how the new government can restore the justice system

In the first of a new series, Louise Crush of Westgate Wealth considers the fundamental need for financial protection

Unlocking your aged debt to fund your tax in one easy step. By Philip N Bristow

Possibly, but many barristers are glad he did…

Mental health charity Mind BWW has received a £500 donation from drug, alcohol and DNA testing laboratory, AlphaBiolabs as part of its Giving Back campaign

The Institute of Neurotechnology & Law is thrilled to announce its inaugural essay competition

How to navigate open source evidence in an era of deepfakes. By Professor Yvonne McDermott Rees and Professor Alexa Koenig

Brie Stevens-Hoare KC and Lyndsey de Mestre KC take a look at the difficulties women encounter during the menopause, and offer some practical tips for individuals and chambers to make things easier

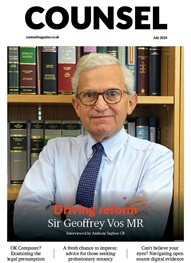

Sir Geoffrey Vos, Master of the Rolls and Head of Civil Justice since January 2021, is well known for his passion for access to justice and all things digital. Perhaps less widely known is the driven personality and wanderlust that lies behind this, as Anthony Inglese CB discovers

The Chair of the Bar sets out how the new government can restore the justice system

No-one should have to live in sub-standard accommodation, says Antony Hodari Solicitors. We are tackling the problem of bad housing with a two-pronged approach and act on behalf of tenants in both the civil and criminal courts