*/

Almost three years after the Bribery Act 2010 came into force, a new weapon for UK prosecutors, enshrined in the Crime and Courts Act 2013, came into effect on 24 February 2014, whereby the Serious Fraud Office and the Director of Public Prosecutions picked up the carrot of Deferred Prosecution Agreements (DPA) to add to the stick of the Bribery Act.

DPAs in the US federal system have been used by the Department of Justice in criminal prosecutions and the Securities and Exchange Commission in securities enforcement actions for over 20 years, and this inherently US approach has proved, to a large extent, successful.

A DPA in the UK is an agreement reached under judicial supervision between the prosecutor and an organisation, and it allows a prosecution to be suspended for a defined period provided the organisation meets certain specified conditions. Although there are many differences between DPAs in the US and in the UK, the principles are the same.

The UK has come late to the DPAs party, but their introduction is a positive development and a change from how the UK has traditionally viewed corruption in both its jurisdiction and overseas. Corruption is a global problem that demands international solutions and a modern approach of fighting. It is for national and international prosecutorial authorities to work closer together and develop systems that encourage self-disclosure like DPAs. The UK has generally relied upon its own rich legal history, but the introduction of DPAs squarely based on the US model is a welcome addition to the armoury of mechanisms available in the global anti-corruption fight, and the mere fact that the UK is prepared to adopt a foreign system is promising.

More needs to be done, however, as the same old problems remain (e.g., lengthy and expensive proceedings that are difficult to prove and that are not rehabilitation based) and we need to look beyond criminal law if we are to progress faster than corruption advances. In this regard, lots more can be learned from the investigative units and anti-corruption offices of the International Financial Institutions (IFIs) and Multilateral Development Banks (MDBs), where not only are intelligence sharing and self-reporting mechanisms prolific, but a more “commercial” sanctions-based civil system is the norm.

The IFIs/MDBs such as the World Bank and the Asian Development Bank (AsDB) provide funding for development projects undertaken by companies around the world. Vast sums of money are loaned each year and the MDBs must ensure that their funds are being properly managed. Each MDB is equipped with an investigative unit (such as the Office of Anticorruption and Integrity in the case of the AsDB), whose mandate is to carry out independent investigations into allegations of corruption, fraud and other sanctionable practices in IFI/ MDB financed operations. In contrast to the investigative office of the World Bank, those of the AsDB and African Development Bank are more effective because they take a more commercially expedient view.

The IFIs/MDBs have their own sanctions procedures that are in stark contrast to traditional national enforcement mechanisms and have helped shape the future in the fight against corruption. Examples of these international developments and procedures include:

These developments in the IFI/MDB world have modernised the international fight against corruption and provide companies with the ability to minimise the impact of findings of guilt, whilst offering them a constructive way to reform and prevent repetition of misconduct. Moving away from categorising corruption as a purely criminal matter has opened the door to lowering the standard of proof and increased international settlements. It is, perhaps, too early to introduce all of the measures used by the IFI/MDB community in a national jurisdiction like the UK, but we should not shy away from the progress achieved by other entities in the global fight against corruption.

A DPA in the UK is an agreement reached under judicial supervision between the prosecutor and an organisation, and it allows a prosecution to be suspended for a defined period provided the organisation meets certain specified conditions. Although there are many differences between DPAs in the US and in the UK, the principles are the same.

The UK has come late to the DPAs party, but their introduction is a positive development and a change from how the UK has traditionally viewed corruption in both its jurisdiction and overseas. Corruption is a global problem that demands international solutions and a modern approach of fighting. It is for national and international prosecutorial authorities to work closer together and develop systems that encourage self-disclosure like DPAs. The UK has generally relied upon its own rich legal history, but the introduction of DPAs squarely based on the US model is a welcome addition to the armoury of mechanisms available in the global anti-corruption fight, and the mere fact that the UK is prepared to adopt a foreign system is promising.

More needs to be done, however, as the same old problems remain (e.g., lengthy and expensive proceedings that are difficult to prove and that are not rehabilitation based) and we need to look beyond criminal law if we are to progress faster than corruption advances. In this regard, lots more can be learned from the investigative units and anti-corruption offices of the International Financial Institutions (IFIs) and Multilateral Development Banks (MDBs), where not only are intelligence sharing and self-reporting mechanisms prolific, but a more “commercial” sanctions-based civil system is the norm.

The IFIs/MDBs such as the World Bank and the Asian Development Bank (AsDB) provide funding for development projects undertaken by companies around the world. Vast sums of money are loaned each year and the MDBs must ensure that their funds are being properly managed. Each MDB is equipped with an investigative unit (such as the Office of Anticorruption and Integrity in the case of the AsDB), whose mandate is to carry out independent investigations into allegations of corruption, fraud and other sanctionable practices in IFI/ MDB financed operations. In contrast to the investigative office of the World Bank, those of the AsDB and African Development Bank are more effective because they take a more commercially expedient view.

The IFIs/MDBs have their own sanctions procedures that are in stark contrast to traditional national enforcement mechanisms and have helped shape the future in the fight against corruption. Examples of these international developments and procedures include:

These developments in the IFI/MDB world have modernised the international fight against corruption and provide companies with the ability to minimise the impact of findings of guilt, whilst offering them a constructive way to reform and prevent repetition of misconduct. Moving away from categorising corruption as a purely criminal matter has opened the door to lowering the standard of proof and increased international settlements. It is, perhaps, too early to introduce all of the measures used by the IFI/MDB community in a national jurisdiction like the UK, but we should not shy away from the progress achieved by other entities in the global fight against corruption.

Almost three years after the Bribery Act 2010 came into force, a new weapon for UK prosecutors, enshrined in the Crime and Courts Act 2013, came into effect on 24 February 2014, whereby the Serious Fraud Office and the Director of Public Prosecutions picked up the carrot of Deferred Prosecution Agreements (DPA) to add to the stick of the Bribery Act.

DPAs in the US federal system have been used by the Department of Justice in criminal prosecutions and the Securities and Exchange Commission in securities enforcement actions for over 20 years, and this inherently US approach has proved, to a large extent, successful.

The Chair of the Bar sets out how the new government can restore the justice system

In the first of a new series, Louise Crush of Westgate Wealth considers the fundamental need for financial protection

Unlocking your aged debt to fund your tax in one easy step. By Philip N Bristow

Possibly, but many barristers are glad he did…

Mental health charity Mind BWW has received a £500 donation from drug, alcohol and DNA testing laboratory, AlphaBiolabs as part of its Giving Back campaign

The Institute of Neurotechnology & Law is thrilled to announce its inaugural essay competition

How to navigate open source evidence in an era of deepfakes. By Professor Yvonne McDermott Rees and Professor Alexa Koenig

Brie Stevens-Hoare KC and Lyndsey de Mestre KC take a look at the difficulties women encounter during the menopause, and offer some practical tips for individuals and chambers to make things easier

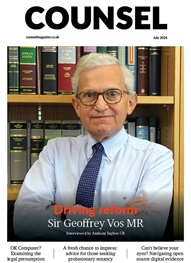

Sir Geoffrey Vos, Master of the Rolls and Head of Civil Justice since January 2021, is well known for his passion for access to justice and all things digital. Perhaps less widely known is the driven personality and wanderlust that lies behind this, as Anthony Inglese CB discovers

The Chair of the Bar sets out how the new government can restore the justice system

No-one should have to live in sub-standard accommodation, says Antony Hodari Solicitors. We are tackling the problem of bad housing with a two-pronged approach and act on behalf of tenants in both the civil and criminal courts