*/

Britain is making a bid to become the next global centre of Islamic finance, with preparations under way for a £200m bond-like sukuk issue. Scott Morrison explains the background.

Last October and for the first time, the UK hosted the World Islamic Economic Forum. Prime Minister David Cameron took the opportunity to promote Islamic banking and finance in the UK, advancing London as a centre that would “stand alongside Dubai and Kuala Lumpur as one of the great capitals of Islamic finance anywhere in the world”. Specifically Mr Cameron announced preparations under way at HM Treasury to issue “a bond-like sukuk worth around £200m”, expected either this year or next.

The sukuk issue would represent a culmination of expert groups and consultations convened since 2007; and the gathering desire of the current, and previous Labour, governments to invite global Islamic banking and finance into Britain. The terms of that invitation are promises of “no discrimination” and of a regulatory regime that presents “no obstacles but no special favours”.

Sovereign sukuk in Europe

In his speech (29 October 2013) Mr Cameron stated that a sovereign sukuk had never been issued outside the Islamic world; and that his Government wanted the UK to be the first to do so.

In fact it is a decade too late for that. In 2004 the German state of Saxony-Anhalt issued Europe’s first sovereign sukuk for €100m. However, depending on the celerity of British preparations, which no observer would characterise as overhasty so far, Britain could still beat Luxembourg to issue the second European sukuk.

Scope and symbolism

The proposed £200m is modest, whether by comparison with the gilt market or public financing broadly or to past sukuk; a notable example being the US$2bn sovereign issue of the Dubai Civil Aviation Authority in 2004.

However, it would be a mistake to assess the UK’s sukuk purely by volume. It is better understood as a symbolic gesture intended to signify the social inclusion of British Muslims – as is the wider effort to license Islamic financial institutions. The minimum investment of the upcoming issuance is unknown; however sukuk elsewhere have typically targeted institutional investors, with minimum investments individual investors would find prohibitive.

For this reason, retail banks and ‘windows’ compliant with Islamic precepts (commonly glossed as Shari’a or Islamic law) are more promising means of allowing British Muslims to live financial lives consonant with their faith’s principles. The UK sukuk is also a tentative bid to attract inward foreign investment and to access liquidity – especially, but not exclusively, in the oil and gas rich states of the Gulf. It is a means of developing a new capital market and instrument that can diversify portfolios and act as a signalling mechanism that would encourage (larger) corporate issuances. It would lend credibility both to sukuk and to the wider Islamic finance industry – in which it is the most prominent product at present.

What is ‘Sukuk’?

As with other instruments in Islamic finance, the retained Arabic verbiage renders meanings more opaque than they actually are. A sukuk is in essence a capital market overlay. Underneath it may be any one (or combination) of 14 contract types that are widely accepted by scholars and schools of Islamic commercial jurisprudence.

From the Shari’a perspective, the underlying contract or contracts should have as their subject matter tangible, physical assets (subject to some exceptions) which are themselves lawful; for instance the asset(s) must not involve gambling, alcohol, tobacco, pork, or pornography. Sukuk should be used to raise funds for specific projects and investment activity, not for generalised financial needs.

Sukuk are securities. However, whether or not they may be traded on secondary markets depends on the underlying contract type. The most often stated definition of sukuk is that of the Bahrain-based Auditing and Accounting Organisation for Islamic Financial Institutions (AAOIFI): sukuk are certificates of equal value representing undivided shares in the ownership of tangible assets, usufructs and services or (in the ownership of) the assets of particular projects or special investment activity. It is the requirement of ownership which supports the claim that sukuk are equity not debt instruments. This is a fundamental distinction for Islamic law because the dominant view is that trading in debt is unlawful, as is the commodification of money; further, charging or paying interest are the cardinal sins Islamic finance seeks to discourage and to prevent. These are also the reasons why the Islamic banking and finance industry is at pains to distinguish sukuk from bonds, however similar their economic operation and regulatory or tax treatment may be.

"Depending on the celerity of British preparations – which no observer would characterise as overhasty so far – Britain could still beat Luxembourg to issue the second European sukuk"

Finally, the investment already made in knowledge and informational infrastructure make efficiency gains and the reduction of transaction costs possible for future issuances.

Whilst in March the financial secretary to the Treasury, Sajid Javid MP, emphasised that there was no intention of an iterated sovereign issue, these gains would also transfer over to corporate issuances.

Contractual structure: Ijara

The UK Government has not stated which contractual structure will underpin its sovereign sukuk issue. The combined consultations of HM Treasury, the Debt Management Office and as it then was the Financial Services Authority suggest a ‘plain vanilla’ ijara sukuk is most likely.

Ijara is a sale and leaseback contract. Ijara also happens to be the dominant type of sukuk globally, measured by volume. It is arguably the most widely accepted, best known, and most certain in its financial results. With this type, the sukuk represent a proportional beneficial ownership in an asset, and a right to the cash flowing from that asset. A simple trust rests at its core.

What follows is a schematic, simplified statement of how the UK issue would unfold, assuming an ijara sukuk.

A special purpose vehicle (SPV) acting as the (bankruptcy remote) agent of the government collects the sukuk proceeds from investors who receive sukuk al-ijara (certificates) in exchange. The SPV purchases the asset from the government. The SPV, holding the asset (or pool of assets) on trust, then leases the asset back to the government. The government as lessee is liable for maintenance. In case of default the asset reverts to the government due to the operation of a purchase undertaking. The commercially agreed rent paid by the government and transferred by the SPV to the sukuk-holders is the equivalent of the periodic coupon payments in a conventional bond. In contrast with some other shari’a-compliant contracts, in an ijara sukuk these payments may be fixed, as can the value of the asset for re-purchase at maturity – which will probably be in the three-to-five year range; a shorter-term bill-like sukuk was considered but rejected.

Future of UK Islamic finance

For tax and regulatory purposes ijara sukuk is deemed a ‘debt like’ structure, and an alternative finance investment bond (AFIB). Such treatment results from the insertion of article 77A into the Financial Services and Markets Act 2000 (Regulated Activities) Order 2001 (SI 2001/544) and amendments to a number of other statutory instruments. Even so, there remain VAT and stamp duty land tax (SDLT) implications which diminish some AFIBs’ competitiveness.

There is insufficient space in this article to analyse further regulatory and technical aspects attendant upon both bonds and sukuk. For example, rating, insurance, denomination, fixed or floating rates, yields and benchmarking, listing, registration, the impacts on gilts and secondary markets. As with any Shari’a-compliant transaction, sukuk documentation must pass muster with a board of Shari’a scholars, which raises corporate governance issues and the risks of arbitrage – matters that have not been touched upon here.

Notwithstanding whatever criticism might be made of the Government’s handling of this sovereign sukuk, the reasons why it would choose at this moment to make a bid for Britain to become a global centre of Islamic finance (and to do so by means of originating a sovereign sukuk) are sound. Islamic finance is increasing in volume and competitiveness. It is an industry in which this country possesses a comparative advantage – certainly compared to other western countries.

The elements of that comparative advantage include the reputation of the legal and judicial system; the City of London’s geo-strategic location, and its concentrated expertise and experience in conventional banking and finance; the Muslim population and home market for retail banking services; and historical and continuing ties (reflected in the flow of capital, trade, and immigration) with the Muslim-majority societies of the Middle East, Asia and Africa – including certainly but also extending well beyond the Commonwealth countries.

The sukuk issue would represent a culmination of expert groups and consultations convened since 2007; and the gathering desire of the current, and previous Labour, governments to invite global Islamic banking and finance into Britain. The terms of that invitation are promises of “no discrimination” and of a regulatory regime that presents “no obstacles but no special favours”.

Sovereign sukuk in Europe

In his speech (29 October 2013) Mr Cameron stated that a sovereign sukuk had never been issued outside the Islamic world; and that his Government wanted the UK to be the first to do so.

In fact it is a decade too late for that. In 2004 the German state of Saxony-Anhalt issued Europe’s first sovereign sukuk for €100m. However, depending on the celerity of British preparations, which no observer would characterise as overhasty so far, Britain could still beat Luxembourg to issue the second European sukuk.

Scope and symbolism

The proposed £200m is modest, whether by comparison with the gilt market or public financing broadly or to past sukuk; a notable example being the US$2bn sovereign issue of the Dubai Civil Aviation Authority in 2004.

However, it would be a mistake to assess the UK’s sukuk purely by volume. It is better understood as a symbolic gesture intended to signify the social inclusion of British Muslims – as is the wider effort to license Islamic financial institutions. The minimum investment of the upcoming issuance is unknown; however sukuk elsewhere have typically targeted institutional investors, with minimum investments individual investors would find prohibitive.

For this reason, retail banks and ‘windows’ compliant with Islamic precepts (commonly glossed as Shari’a or Islamic law) are more promising means of allowing British Muslims to live financial lives consonant with their faith’s principles. The UK sukuk is also a tentative bid to attract inward foreign investment and to access liquidity – especially, but not exclusively, in the oil and gas rich states of the Gulf. It is a means of developing a new capital market and instrument that can diversify portfolios and act as a signalling mechanism that would encourage (larger) corporate issuances. It would lend credibility both to sukuk and to the wider Islamic finance industry – in which it is the most prominent product at present.

What is ‘Sukuk’?

As with other instruments in Islamic finance, the retained Arabic verbiage renders meanings more opaque than they actually are. A sukuk is in essence a capital market overlay. Underneath it may be any one (or combination) of 14 contract types that are widely accepted by scholars and schools of Islamic commercial jurisprudence.

From the Shari’a perspective, the underlying contract or contracts should have as their subject matter tangible, physical assets (subject to some exceptions) which are themselves lawful; for instance the asset(s) must not involve gambling, alcohol, tobacco, pork, or pornography. Sukuk should be used to raise funds for specific projects and investment activity, not for generalised financial needs.

Sukuk are securities. However, whether or not they may be traded on secondary markets depends on the underlying contract type. The most often stated definition of sukuk is that of the Bahrain-based Auditing and Accounting Organisation for Islamic Financial Institutions (AAOIFI): sukuk are certificates of equal value representing undivided shares in the ownership of tangible assets, usufructs and services or (in the ownership of) the assets of particular projects or special investment activity. It is the requirement of ownership which supports the claim that sukuk are equity not debt instruments. This is a fundamental distinction for Islamic law because the dominant view is that trading in debt is unlawful, as is the commodification of money; further, charging or paying interest are the cardinal sins Islamic finance seeks to discourage and to prevent. These are also the reasons why the Islamic banking and finance industry is at pains to distinguish sukuk from bonds, however similar their economic operation and regulatory or tax treatment may be.

"Depending on the celerity of British preparations – which no observer would characterise as overhasty so far – Britain could still beat Luxembourg to issue the second European sukuk"

Finally, the investment already made in knowledge and informational infrastructure make efficiency gains and the reduction of transaction costs possible for future issuances.

Whilst in March the financial secretary to the Treasury, Sajid Javid MP, emphasised that there was no intention of an iterated sovereign issue, these gains would also transfer over to corporate issuances.

Contractual structure: Ijara

The UK Government has not stated which contractual structure will underpin its sovereign sukuk issue. The combined consultations of HM Treasury, the Debt Management Office and as it then was the Financial Services Authority suggest a ‘plain vanilla’ ijara sukuk is most likely.

Ijara is a sale and leaseback contract. Ijara also happens to be the dominant type of sukuk globally, measured by volume. It is arguably the most widely accepted, best known, and most certain in its financial results. With this type, the sukuk represent a proportional beneficial ownership in an asset, and a right to the cash flowing from that asset. A simple trust rests at its core.

What follows is a schematic, simplified statement of how the UK issue would unfold, assuming an ijara sukuk.

A special purpose vehicle (SPV) acting as the (bankruptcy remote) agent of the government collects the sukuk proceeds from investors who receive sukuk al-ijara (certificates) in exchange. The SPV purchases the asset from the government. The SPV, holding the asset (or pool of assets) on trust, then leases the asset back to the government. The government as lessee is liable for maintenance. In case of default the asset reverts to the government due to the operation of a purchase undertaking. The commercially agreed rent paid by the government and transferred by the SPV to the sukuk-holders is the equivalent of the periodic coupon payments in a conventional bond. In contrast with some other shari’a-compliant contracts, in an ijara sukuk these payments may be fixed, as can the value of the asset for re-purchase at maturity – which will probably be in the three-to-five year range; a shorter-term bill-like sukuk was considered but rejected.

Future of UK Islamic finance

For tax and regulatory purposes ijara sukuk is deemed a ‘debt like’ structure, and an alternative finance investment bond (AFIB). Such treatment results from the insertion of article 77A into the Financial Services and Markets Act 2000 (Regulated Activities) Order 2001 (SI 2001/544) and amendments to a number of other statutory instruments. Even so, there remain VAT and stamp duty land tax (SDLT) implications which diminish some AFIBs’ competitiveness.

There is insufficient space in this article to analyse further regulatory and technical aspects attendant upon both bonds and sukuk. For example, rating, insurance, denomination, fixed or floating rates, yields and benchmarking, listing, registration, the impacts on gilts and secondary markets. As with any Shari’a-compliant transaction, sukuk documentation must pass muster with a board of Shari’a scholars, which raises corporate governance issues and the risks of arbitrage – matters that have not been touched upon here.

Notwithstanding whatever criticism might be made of the Government’s handling of this sovereign sukuk, the reasons why it would choose at this moment to make a bid for Britain to become a global centre of Islamic finance (and to do so by means of originating a sovereign sukuk) are sound. Islamic finance is increasing in volume and competitiveness. It is an industry in which this country possesses a comparative advantage – certainly compared to other western countries.

The elements of that comparative advantage include the reputation of the legal and judicial system; the City of London’s geo-strategic location, and its concentrated expertise and experience in conventional banking and finance; the Muslim population and home market for retail banking services; and historical and continuing ties (reflected in the flow of capital, trade, and immigration) with the Muslim-majority societies of the Middle East, Asia and Africa – including certainly but also extending well beyond the Commonwealth countries.

Britain is making a bid to become the next global centre of Islamic finance, with preparations under way for a £200m bond-like sukuk issue. Scott Morrison explains the background.

Last October and for the first time, the UK hosted the World Islamic Economic Forum. Prime Minister David Cameron took the opportunity to promote Islamic banking and finance in the UK, advancing London as a centre that would “stand alongside Dubai and Kuala Lumpur as one of the great capitals of Islamic finance anywhere in the world”. Specifically Mr Cameron announced preparations under way at HM Treasury to issue “a bond-like sukuk worth around £200m”, expected either this year or next.

The Chair of the Bar sets out how the new government can restore the justice system

In the first of a new series, Louise Crush of Westgate Wealth considers the fundamental need for financial protection

Unlocking your aged debt to fund your tax in one easy step. By Philip N Bristow

Possibly, but many barristers are glad he did…

Mental health charity Mind BWW has received a £500 donation from drug, alcohol and DNA testing laboratory, AlphaBiolabs as part of its Giving Back campaign

The Institute of Neurotechnology & Law is thrilled to announce its inaugural essay competition

How to navigate open source evidence in an era of deepfakes. By Professor Yvonne McDermott Rees and Professor Alexa Koenig

Brie Stevens-Hoare KC and Lyndsey de Mestre KC take a look at the difficulties women encounter during the menopause, and offer some practical tips for individuals and chambers to make things easier

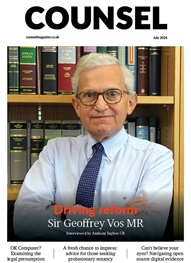

Sir Geoffrey Vos, Master of the Rolls and Head of Civil Justice since January 2021, is well known for his passion for access to justice and all things digital. Perhaps less widely known is the driven personality and wanderlust that lies behind this, as Anthony Inglese CB discovers

The Chair of the Bar sets out how the new government can restore the justice system

No-one should have to live in sub-standard accommodation, says Antony Hodari Solicitors. We are tackling the problem of bad housing with a two-pronged approach and act on behalf of tenants in both the civil and criminal courts