*/

Where to look for buried bones? From the world of forensic accountancy, a checklist for barristers on valuing a business asset

By Michael George and Andrew Donaldson

Most of us are able to find our way around the balance sheets and profit and loss accounts of a company, but there are matters which are frequently overlooked. This is a vast subject and this article selects a few choice areas when dealing with a business asset.

Regularly, only the filed accounts are furnished on disclosure. Always ensure that full accounts have been disclosed. Any competent single joint expert (SJE) will need these but this is frequently overlooked. All too often we have seen disclosed accounts without accompanying notes: make sure you have the notes and the detailed profit analyses that are usually prepared by the company accountants.

The temptation for a business owner to downplay the prospects of the business is often irresistible. Ask for the business plan. One may be prepared for internal reasons or to gain bank funding; Coronavirus Business Interruption Loan Scheme (CBILS) loans usually required a business plan.

While a valuation prepared by the company accountant may superficially look attractive, it may be, on simple analysis, risible. Remember they are producing the valuation for their client and will not be viewing the business dispassionately. Commonly, the company accountant will advance a net asset valuation when it is wholly inappropriate. We have known this even when the accountant is supposedly engaged by both parties and purportedly neutral.

A one-person personal services company is unlikely to have any value other than its net assets.

Do not underestimate the inherent problems in attempting to value a small private company where there is limited market activity to which to compare it. There has been significant judicial comment:

‘… In my experience, valuations of shares in private companies are among the most fragile valuations which can be obtained.’ (Moylan J in H v H [2008] EWHC 935 (Fam) §5)

‘Valuations are often a matter of opinion on which experts differ. A thorough investigation into these differences can be extremely expensive and of doubtful utility.’ (Lord Nicholls in Miller v Miller; McFarlane v McFarlane [2006] UKHL 24 at §26)

‘The reasons for this are many. In the first place there is likely to be no obvious market for a private company. Second, even where valuers use the same method of valuation they are likely to produce widely differing results. Third, the profitability of private companies may be volatile, such that a snapshot valuation at a particular date may give an unfair picture. Fourth, the difference in quality between a value attributed to a private company on the basis of opinion evidence and a sum in hard cash is obvious. Fifth, the acid test of any valuation is exposure to the real market, which is simply not possible in the case of a private company where no one suggests that it should be sold.’ (Lewison LJ in Versteegh v Versteegh [2018] EWCA Civ 1050 at §185)

In G v T [2020] EWHC 1613 (Fam) Nicholas Cusworth QC provides an excellent review of the authorities in this area. (See also We all need a G v T, Michael George, 3PB Briefing Note.)

Think what the nature of the company is and its trading activity: even where the figures are large, a valuation may not be appropriate (see Cooper-Hohn v Hohn [2014] EWHC 4122 (Fam)).

Also bear in mind the risk of double counting the capital and income source (see V v V [2005] 2 FLR 697).

Often it is patently obvious from the outset that an SJE will need to be instructed and yet the application is accompanied by reams of questions about the business. The questions may be relevant to the issue of valuation, but it is worth remembering that, if properly instructed, the expert will liaise directly with the parties and will make their own focused enquiries.

When the expert begins to probe it can often provoke pushback from the party who is looking to give the appearance of a less than valuable asset.

It often saves problems further down the line if there is a direction for agreement that the parties will respond within seven days to any request by the SJE. We recommend that authority is granted as part of the letter of instruction, or in the order itself, for the expert to liaise directly with the external company accountant and/or finance director if appropriate.

Lay parties, in particular, assume that because a forensic accountant has been appointed there will be an ‘audit’. Generally, the instruction is to value the business and make enquiries about liquidity. Requests for information will be proportionate to the court’s objective and replies will be taken at face value unless obviously out of kilter.

If there are serious reservations that the company is being run as the proprietor’s ‘piggy bank’ where significant personal expenses are being ‘put through the books’ and not posted as drawings or benefits in kind, then it may well be appropriate to seek disclosure of company bank accounts, director’s loan account and the like.

Caution should be exercised in just how this is presented to the court. A general request for a detailed enquiry seldom goes down well and rightly raises concerns of proportionality in the judicial mind. Focused questions backed up by specific anecdotes are far more likely to secure the disclosure that is being sought.

The sort of thing that one comes across are an extravagant lifestyle being categorised as business meetings, or extensive and expensive holidays being posted to the books as business trips, domestic furniture refurbishments or other personal expenditure regarded as office expenses or even an entire family home being renovated on the books and the costs posted to other jobs.

There is nothing wrong in asking the SJE to give an overview but remember that it is difficult to prove if that business trip was really a holiday. Tactically, it is wise to pick one’s targets and manage lay client’s expectations from the outset.

Where the company owns premises or plant, it is highly unlikely that the accounts value will reflect the market value. Some analysis of the balance sheet should be undertaken at an early stage prior to the Part 25 application to consider whether separate experts need to be instructed to value premises and plant.

Generally, the accounts value of such assets underrepresent their true value because valuations may be out of date or assets may have been depreciated. Rarely, the book value will be inflated – mostly when small companies are looking to borrow monies and want to present a more favourable position to their bankers.

It is not uncommon, indeed it is prudent business practice, for capital assets to be in a different structure from the trading company. This protects the capital assets in the event that the trading company fails. The most common structure is either a separate company (Propco) or the tax efficient structure of the Self Invested Pension Plan (SIPP) and the trading company will pay rent to the Propco or SIPP.

Careful consideration should be given to valuing the SIPP property. We have seen property valuations for the SIPP produced by a RICS surveyor, manifestly for the trustees, who are mortified to discover that the report has been deployed in litigation and produced a markedly different Part 25 valuation.

Give careful consideration to ensure that any rent being paid to the Propco or SIPP is the market rate. If something other than the market rate is being paid it will distort the value of one asset at the expense of another. The business owner may well charge a below market rent to assist the trading company or alternatively charge an above market rent as a tax efficient method of extracting funds from the business. This has the effect of flattering or suppressing the profitability of the trading company. Even a relatively modest disparity from market rates can have a significant effect on the overall valuation because of the use of multipliers by the expert.

The SJE will normally pick this up, but they are frequently misunderstood by practitioners. If you are dealing with a modest asset case where no SJE has been instructed, make sure that you know exactly what the director’s loan account (DLA) is. It is often not apparent. From the accounts we have seen there have been far too many cases where the DLA is a creditor but the director does not disclose it as a personal asset.

Similarly, do not always assume the DLA will in fact be paid by the company. If the company does not have the resources, then it is little more than a bad debt.

Where a director owes money to the company, and it is outstanding more than nine months after the accounting year end, the loan becomes subject to a charge under s 455 of the Corporation Tax Act 2010. The charge is payable at 32.5% of the outstanding loan balance which must be paid to HMRC until that liability is discharged.

Therefore, a director may rightly say that they need money to clear the DLA by way of dividend or other capital which might improve the liquidity of the company but sometimes the point that s 455 charge monies will also be recouped is overlooked which will further improve liquidity. The SJE should pick up on this but it may not be flagged up by a company accountant valuation.

These can have a significant effect on valuations as a quasi-partnership can negate a discount for the minority shareholding: see Ebrahimi v Westbourne Galleries Ltd [1973] AC 360. This is a matter for the court rather than the SJE though often it is appropriate to ask the SJE to identify features which may be consistent or not with a quasi-partnership. Too frequently the points are overlooked or simply taken as read. The main elements of a quasi-partnership are as follows:

(a) it is formed or continued on the basis of a personal relationship involving mutual confidence;

(b) an agreement that all or some of the shareholders shall participate in the conduct of the business;

(c) restrictions on the transfer of shares.

It is often assumed that because shareholders are related there is automatically a personal relationship of mutual confidence. This is often not the case with family businesses and it should not be taken as read. The SJE can also provide an opinion on the discount, if appropriate.

Most of us are able to find our way around the balance sheets and profit and loss accounts of a company, but there are matters which are frequently overlooked. This is a vast subject and this article selects a few choice areas when dealing with a business asset.

Regularly, only the filed accounts are furnished on disclosure. Always ensure that full accounts have been disclosed. Any competent single joint expert (SJE) will need these but this is frequently overlooked. All too often we have seen disclosed accounts without accompanying notes: make sure you have the notes and the detailed profit analyses that are usually prepared by the company accountants.

The temptation for a business owner to downplay the prospects of the business is often irresistible. Ask for the business plan. One may be prepared for internal reasons or to gain bank funding; Coronavirus Business Interruption Loan Scheme (CBILS) loans usually required a business plan.

While a valuation prepared by the company accountant may superficially look attractive, it may be, on simple analysis, risible. Remember they are producing the valuation for their client and will not be viewing the business dispassionately. Commonly, the company accountant will advance a net asset valuation when it is wholly inappropriate. We have known this even when the accountant is supposedly engaged by both parties and purportedly neutral.

A one-person personal services company is unlikely to have any value other than its net assets.

Do not underestimate the inherent problems in attempting to value a small private company where there is limited market activity to which to compare it. There has been significant judicial comment:

‘… In my experience, valuations of shares in private companies are among the most fragile valuations which can be obtained.’ (Moylan J in H v H [2008] EWHC 935 (Fam) §5)

‘Valuations are often a matter of opinion on which experts differ. A thorough investigation into these differences can be extremely expensive and of doubtful utility.’ (Lord Nicholls in Miller v Miller; McFarlane v McFarlane [2006] UKHL 24 at §26)

‘The reasons for this are many. In the first place there is likely to be no obvious market for a private company. Second, even where valuers use the same method of valuation they are likely to produce widely differing results. Third, the profitability of private companies may be volatile, such that a snapshot valuation at a particular date may give an unfair picture. Fourth, the difference in quality between a value attributed to a private company on the basis of opinion evidence and a sum in hard cash is obvious. Fifth, the acid test of any valuation is exposure to the real market, which is simply not possible in the case of a private company where no one suggests that it should be sold.’ (Lewison LJ in Versteegh v Versteegh [2018] EWCA Civ 1050 at §185)

In G v T [2020] EWHC 1613 (Fam) Nicholas Cusworth QC provides an excellent review of the authorities in this area. (See also We all need a G v T, Michael George, 3PB Briefing Note.)

Think what the nature of the company is and its trading activity: even where the figures are large, a valuation may not be appropriate (see Cooper-Hohn v Hohn [2014] EWHC 4122 (Fam)).

Also bear in mind the risk of double counting the capital and income source (see V v V [2005] 2 FLR 697).

Often it is patently obvious from the outset that an SJE will need to be instructed and yet the application is accompanied by reams of questions about the business. The questions may be relevant to the issue of valuation, but it is worth remembering that, if properly instructed, the expert will liaise directly with the parties and will make their own focused enquiries.

When the expert begins to probe it can often provoke pushback from the party who is looking to give the appearance of a less than valuable asset.

It often saves problems further down the line if there is a direction for agreement that the parties will respond within seven days to any request by the SJE. We recommend that authority is granted as part of the letter of instruction, or in the order itself, for the expert to liaise directly with the external company accountant and/or finance director if appropriate.

Lay parties, in particular, assume that because a forensic accountant has been appointed there will be an ‘audit’. Generally, the instruction is to value the business and make enquiries about liquidity. Requests for information will be proportionate to the court’s objective and replies will be taken at face value unless obviously out of kilter.

If there are serious reservations that the company is being run as the proprietor’s ‘piggy bank’ where significant personal expenses are being ‘put through the books’ and not posted as drawings or benefits in kind, then it may well be appropriate to seek disclosure of company bank accounts, director’s loan account and the like.

Caution should be exercised in just how this is presented to the court. A general request for a detailed enquiry seldom goes down well and rightly raises concerns of proportionality in the judicial mind. Focused questions backed up by specific anecdotes are far more likely to secure the disclosure that is being sought.

The sort of thing that one comes across are an extravagant lifestyle being categorised as business meetings, or extensive and expensive holidays being posted to the books as business trips, domestic furniture refurbishments or other personal expenditure regarded as office expenses or even an entire family home being renovated on the books and the costs posted to other jobs.

There is nothing wrong in asking the SJE to give an overview but remember that it is difficult to prove if that business trip was really a holiday. Tactically, it is wise to pick one’s targets and manage lay client’s expectations from the outset.

Where the company owns premises or plant, it is highly unlikely that the accounts value will reflect the market value. Some analysis of the balance sheet should be undertaken at an early stage prior to the Part 25 application to consider whether separate experts need to be instructed to value premises and plant.

Generally, the accounts value of such assets underrepresent their true value because valuations may be out of date or assets may have been depreciated. Rarely, the book value will be inflated – mostly when small companies are looking to borrow monies and want to present a more favourable position to their bankers.

It is not uncommon, indeed it is prudent business practice, for capital assets to be in a different structure from the trading company. This protects the capital assets in the event that the trading company fails. The most common structure is either a separate company (Propco) or the tax efficient structure of the Self Invested Pension Plan (SIPP) and the trading company will pay rent to the Propco or SIPP.

Careful consideration should be given to valuing the SIPP property. We have seen property valuations for the SIPP produced by a RICS surveyor, manifestly for the trustees, who are mortified to discover that the report has been deployed in litigation and produced a markedly different Part 25 valuation.

Give careful consideration to ensure that any rent being paid to the Propco or SIPP is the market rate. If something other than the market rate is being paid it will distort the value of one asset at the expense of another. The business owner may well charge a below market rent to assist the trading company or alternatively charge an above market rent as a tax efficient method of extracting funds from the business. This has the effect of flattering or suppressing the profitability of the trading company. Even a relatively modest disparity from market rates can have a significant effect on the overall valuation because of the use of multipliers by the expert.

The SJE will normally pick this up, but they are frequently misunderstood by practitioners. If you are dealing with a modest asset case where no SJE has been instructed, make sure that you know exactly what the director’s loan account (DLA) is. It is often not apparent. From the accounts we have seen there have been far too many cases where the DLA is a creditor but the director does not disclose it as a personal asset.

Similarly, do not always assume the DLA will in fact be paid by the company. If the company does not have the resources, then it is little more than a bad debt.

Where a director owes money to the company, and it is outstanding more than nine months after the accounting year end, the loan becomes subject to a charge under s 455 of the Corporation Tax Act 2010. The charge is payable at 32.5% of the outstanding loan balance which must be paid to HMRC until that liability is discharged.

Therefore, a director may rightly say that they need money to clear the DLA by way of dividend or other capital which might improve the liquidity of the company but sometimes the point that s 455 charge monies will also be recouped is overlooked which will further improve liquidity. The SJE should pick up on this but it may not be flagged up by a company accountant valuation.

These can have a significant effect on valuations as a quasi-partnership can negate a discount for the minority shareholding: see Ebrahimi v Westbourne Galleries Ltd [1973] AC 360. This is a matter for the court rather than the SJE though often it is appropriate to ask the SJE to identify features which may be consistent or not with a quasi-partnership. Too frequently the points are overlooked or simply taken as read. The main elements of a quasi-partnership are as follows:

(a) it is formed or continued on the basis of a personal relationship involving mutual confidence;

(b) an agreement that all or some of the shareholders shall participate in the conduct of the business;

(c) restrictions on the transfer of shares.

It is often assumed that because shareholders are related there is automatically a personal relationship of mutual confidence. This is often not the case with family businesses and it should not be taken as read. The SJE can also provide an opinion on the discount, if appropriate.

Where to look for buried bones? From the world of forensic accountancy, a checklist for barristers on valuing a business asset

By Michael George and Andrew Donaldson

The Chair of the Bar sets out how the new government can restore the justice system

In the first of a new series, Louise Crush of Westgate Wealth considers the fundamental need for financial protection

Unlocking your aged debt to fund your tax in one easy step. By Philip N Bristow

Possibly, but many barristers are glad he did…

Mental health charity Mind BWW has received a £500 donation from drug, alcohol and DNA testing laboratory, AlphaBiolabs as part of its Giving Back campaign

The Institute of Neurotechnology & Law is thrilled to announce its inaugural essay competition

How to navigate open source evidence in an era of deepfakes. By Professor Yvonne McDermott Rees and Professor Alexa Koenig

Brie Stevens-Hoare KC and Lyndsey de Mestre KC take a look at the difficulties women encounter during the menopause, and offer some practical tips for individuals and chambers to make things easier

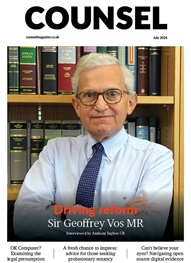

Sir Geoffrey Vos, Master of the Rolls and Head of Civil Justice since January 2021, is well known for his passion for access to justice and all things digital. Perhaps less widely known is the driven personality and wanderlust that lies behind this, as Anthony Inglese CB discovers

The Chair of the Bar sets out how the new government can restore the justice system

No-one should have to live in sub-standard accommodation, says Antony Hodari Solicitors. We are tackling the problem of bad housing with a two-pronged approach and act on behalf of tenants in both the civil and criminal courts